A Standby Letter of Credit (SBLC) is a powerful financial instrument that guarantees payment to a beneficiary if the buyer or applicant fails to meet contractual obligations. It provides trust, security, and credibility in international trade and project finance

What is a Standby Letter of Credit (SBLC)?

A standby letter of credit, abbreviated as SBLC, refers to a legal document where a bank guarantees the payment of a specific amount of money to a seller if the buyer defaults on the agreement.

An SBLC acts as a safety net for the payment of a shipment of physical goods or completed service to the seller, in the event something unforeseen prevents the buyer from making the scheduled payments to the seller. In such a case, the SBLC ensures the required payments are made to the seller after fulfillment of the required obligations.

A standby letter of credit is used in international or domestic transactions where the seller and the buyer do not know each other, and it attempts to hedge out the risks associated with such a transaction. Some of the risks include bankruptcy and insufficient cash flows on the part of the buyer, which prevents them from making payments to the seller on time.

In case of an adverse event, the bank promises to make the required payment to the seller as long as they meet the requirements of the SBLC. The bank payment to the seller is a form of credit, and the customer (buyer) is responsible for paying the principal plus interest as agreed with the bank.

Types of SBLC

1. Financial Standby Letter of Credit

A financial SBLC guarantees payment to the seller or the service provider for the goods or the services rendered as per the agreement within the stipulated time frame.

Example: If an edible dye manufacturer sends a shipment to a soft drink company against a financial SBLC, and the company is unable to pay for it, the issuing bank will step in and pay the manufacturer for the dye. Later on, the soft drink company would have to pay the full amount and interest to the issuing bank.

2. Performance Standby Letter of Credit

A performance SBLC is less commonly used compared to a financial SBLC. Performance SBLCs provide a guarantee of completion of a project as per the agreement or the contract. If the service provider fails to complete the project within a stipulated time frame, the bank steps in and reimburses the client.

Example: An IT company hires a contractor to construct a new office. The contractor agrees to complete the construction within a specific time frame but fails to deliver. However, if this deal is protected by a performance SBLC, the issuing bank will pay entire project fees to the IT company and will charge penalties to the contractor. This acts as a safety check to ensure that heavy budget projects are completed in a timely fashion.

3. Advance Payment SBLC

Advance Payment Standby LC provides security against one party’s failure to pay the other party’s advance payment.

4. Bid bond/ Tender SBLC

Bid bond/Tender Standby LCs act as a security against failure to complete the project once the applicant has been awarded the bid or the tender for it.

5. Insurance SBLC

Insurance SBLC provides support to the beneficiary in case the applicant has committed for insurance or reinsurance but fails to do so.

6. Lease Support SBLC

A lease support SBLC is issued by the bank representing the tenant to the landlord. The bank generally takes a deposit as collateral for the SBLC. It pledges to pay the rent to the landlord in case the tenant is not able to do so.

How does an SBLC work?

Here’s a step by step process of how an SBLC works:

· The process of obtaining an SBLC is fairly simple and similar to that of obtaining any other type of LC or a loan from a bank. A buyer simply walks into a bank or a financial institution and applies for an SBLC.

· The bank then starts looking into the creditworthiness of the applicant and decides whether or not the person should be credited with the SBLC. The bank looks into the financial history of the applicant as well as their credit reports and ratings.

· If the bank suspects that the buyer will not be able to honor the LC, they may ask for additional collateral to be provided. The size of the collateral depends on the risks as well as the nature of the business.

· Once the buyer establishes sufficient creditworthiness, the bank asks for the details of the agreement between the buyer and the seller. Information such as the seller’s name and address, company details, the time period for which SBLC is to be taken as well as shipping documents, etc., are submitted to the bank.

· Once the bank is satisfied with all the information at their disposal and their background checks have yielded satisfactory results, it provides an SBLC to the buyer. The bank charges 1% to 10% of the amount of SBLC as a yearly fee, and it’s applicable until the SBLC is valid.

· If the buyer meets its obligations in the contract before the due date, the bank will terminate the SBLC without a further charge to the buyer. Once the buyer pays the seller for the goods or the services, the bank terminates the SBLC and doesn’t charge him beyond that point.

· As discussed above, SBLC is not actually meant to be used and only acts as a security against default. It comes into action if the buyer is not able to honor the agreement with the seller, the seller goes to the bank and submits the proofs as mentioned in the SBLC. Once the bank verifies the proofs, they release the payment to the seller. The buyer then makes the payment to the bank at a later date along with interest.

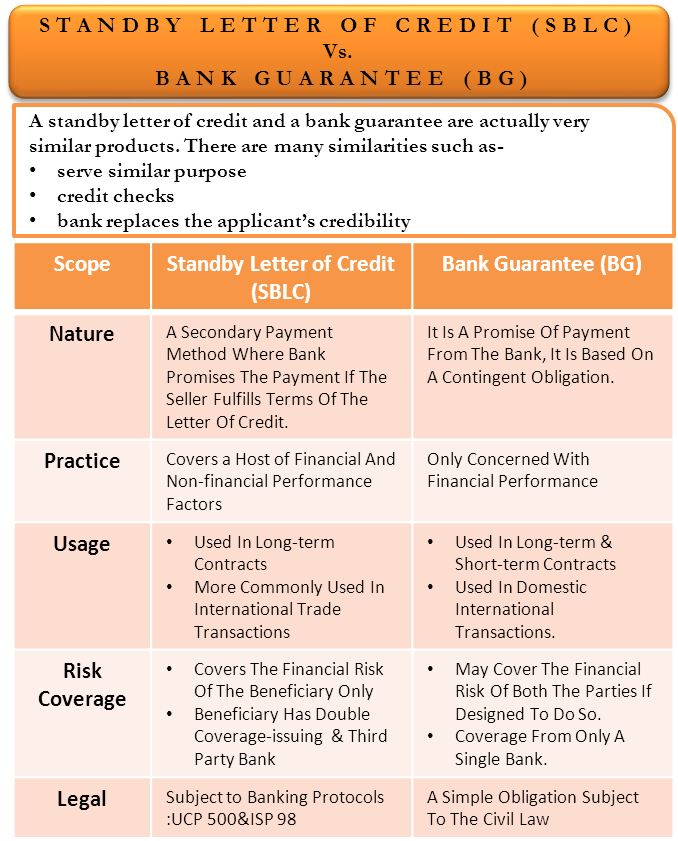

Difference Between Standby Letter of Credit (SBLC) and Bank Guarantee (BG)

The Difference in Nature

A standby letter of credit is a secondary payment method where the bank promises the payment if the seller fulfills the terms of the letter of credit. This means if the buyer fails to pay, then as long as the seller meet’s the requirement of the standby letter of credit, the bank will pay.

Even though a bank guarantee is similar to a standby letter of credit in a way that it is a promise of payment from the bank, it is based on a contingent obligation. This means one can take shelter from a bank guarantee in case of occurrence of a certain contingent event, such as — a project never takes off or a construction project is halted in the middle stage.

Difference in Practice

From a practical perspective, the standby letter of credit is quite different from a bank guarantee. While a bank guarantee is only concerned with financial performance (e.g., sale of goods, construction, etc.), the standby letter of credit is extremely diverse. It covers a host of financial and non-financial performance factors. A standby letter of credit most definitely covers regular financial risk factors such as timely payment of goods. Still, it may also cover non-financial risk factors such as a particular material requirement, defect margin, etc. Thus, we can say that the standby letter of credit is a more holistic instrument compared to a bank guarantee.

Although SBLC and BG serve similar purposes, there are differences between them that make them distinct from each other, including:

1. Nature of Guarantee: An SBLC is a guarantee of payment, while a BG is a guarantee of performance. This means that an SBLC is used to ensure that the beneficiary receives payment in the event that the applicant fails to make payment, while a BG is used to ensure that the applicant performs their obligations under the underlying contract.

2. Parties Involved: In an SBLC, there are usually three parties involved: the applicant, the issuing bank, and the beneficiary. In a BG, there are usually two parties involved: the applicant and the beneficiary.

3. Payment: In an SBLC, payment is made only when the applicant fails to fulfill their obligations under the underlying contract. In a BG, payment may be made even if the applicant has not yet failed to fulfill their obligations under the underlying contract.

Key Benefits of SBLC Business Financing

1. Access to Large-Scale Funding

· SBLCs allow businesses to secure loans or trade credit by using the instrument as collateral, giving them access to financing that might otherwise be unavailable.

2. Enhanced Credibility & Trust

· An SBLC demonstrates financial strength and reliability to banks, suppliers, and partners, which helps build trust in international and domestic transactions.

3. Flexibility of Use

· SBLCs can be used for multiple purposes: trade financing, project funding, securing credit lines, or guaranteeing payments in contracts.

4. Risk Mitigation

· Since the SBLC guarantees payment if the buyer defaults, it reduces the lender’s or seller’s risk. This often leads to better terms, lower upfront costs, or faster deal closure.

5. Improved Cash Flow Management

· Businesses can leverage SBLCs to delay cash outflow while still assuring suppliers or lenders of payment security, keeping liquidity intact for operations.

6. Global Trade Enablement

· SBLCs are widely accepted instruments in international trade, making them an effective tool for importers, exporters, and project developers working across borders.

7. Better Negotiation Power

· With an SBLC in place, companies can often negotiate more favorable pricing, extended payment terms, or higher credit limits with suppliers and lenders.

8. Non-Cash Collateral Advantage

· Since the SBLC itself serves as a form of security, businesses don’t always need to pledge physical assets or tie up working capital.

SBLC Issuance ProcessUnderstanding the Process Between the Issuing and Receiving Bank in an SBLC Transaction

In international trade and structured finance, the Standby Letter of Credit (SBLC) is a pivotal instrument offering assurance of payment to beneficiaries. It serves as a credit enhancement mechanism where the issuing bank guarantees payment on behalf of the applicant (buyer) if the applicant fails to fulfil their contractual obligations. This article outlines the structured and sequential process — specifically between the issuing and receiving banks — that underpins the issuance of an SBLC, including a detailed explanation of the SWIFT messaging involved.

Step-by-Step Process: From Commencement to SBLC Issuance

1. Contractual Agreement Between Buyer and Seller

- The buyer and seller enter into a formal contract that stipulates the use of a Standby Letter of Credit as the payment security mechanism.

- The contract outlines key terms such as the SBLC amount, tenor, issuing and receiving bank details, acceptable format, and conditions of drawdown.

2. Buyer Requests SBLC from Their Bank

- The buyer submits a formal SBLC application to their bank (the issuing bank), enclosing the signed contract and the beneficiary’s bank coordinates.

- The buyer’s bank will conduct compliance checks, credit assessment, and verify internal limits before proceeding.

3. Draft SBLC Text for Approval

- The issuing bank prepares a draft of the SBLC in accordance with the contract terms and sends it to the buyer and, where applicable, the beneficiary for review and approval.

- The draft includes key elements such as:

- Beneficiary name and address

- SBLC amount and currency

- Expiry date and place

- Drawdown conditions

- Confirmation of irrevocability

- Governing rules (e.g., ISP98 or UCP600)

4. Transmission of SWIFT MT799 (Pre-Advice Message)

- Once the SBLC draft is approved, the issuing bank typically sends a SWIFT MT799 to the receiving bank (beneficiary’s bank).

- Purpose: The MT799 acts as a pre-advice message, confirming the intention to issue a specific SBLC. It includes preliminary details such as:

- Confirmation of intent to issue a specific SBLC

- Details of the issuing bank

- Statement that the SBLC will be irrevocable, unconditional, and cash-backed

- Confirmation that funds are available or reserved

5. Receiving Bank Responds to MT799

- The receiving bank may reply with an MT799 or MT999 acknowledging the receipt and confirming readiness to receive the formal instrument.

- In some cases, the receiving bank may request changes to the format, wording, or issuing terms, especially if it acts as advising or confirming bank.

6. Issuance of SBLC via SWIFT MT760

- Upon successful completion of due diligence and mutual confirmation, the issuing bank transmits the actual Standby Letter of Credit to the beneficiary’s bank using a SWIFT MT760.

- MT760 Message Contents typically include:

- SBLC Reference Number

- Issuer and Beneficiary Bank details

- Full legal name of applicant (buyer) and beneficiary (seller)

- Amount and currency

- Effective and expiry dates

- Detailed terms and drawdown conditions

- Governing rules and applicable law

7. Acknowledgement by Receiving Bank

- The receiving bank reviews the MT760 and confirms receipt to the beneficiary.

- The bank may also issue an MT799 or internal notification to advise the beneficiary that the SBLC has been received and is now operative.

8. Confirmation (Optional)

- Where required, the beneficiary may request that the SBLC be confirmed by a reputable bank, especially if the issuing bank is in a high-risk or unfamiliar jurisdiction.

- The confirming bank adds its own undertaking of payment and typically confirms via SWIFT MT799 or internal messaging systems.

9. Utilisation of SBLC

- If the buyer fails to perform as per the contract, the beneficiary may draw on the SBLC by presenting documents as required (e.g., a demand for payment or performance certificate).

- The receiving bank forwards the demand to the issuing bank, typically using SWIFT MT799 or MT999 with attached PDF evidence.

- Upon validation, the issuing bank honours the payment obligation and transfers funds accordingly.

10. Cancellation or Expiry

- If no draw is made, the SBLC expires on the stated date.

- The issuing bank may send an MT799 or MT759 (Advice of Non-Utilisation or Cancellation) to formally close the instrument.

Conclusion

A Standby Letter of Credit (SBLC) is far more than just a financial instrument — it is a powerful tool that safeguards transactions, enhances business credibility, and unlocks financing opportunities across global markets. By acting as a payment guarantee, an SBLC provides sellers, lenders, and project stakeholders with the confidence that their financial interests are protected, even in the face of unforeseen defaults or disruptions.

Whether structured as a financial, performance, or specialized SBLC, these instruments bridge the trust gap between buyers and sellers, particularly in international trade where risks are heightened. Beyond security, they empower businesses with tangible benefits such as improved liquidity, stronger negotiation leverage, and access to large-scale funding without the need to pledge physical assets.

The issuance process — though detailed and compliance-driven — ensures transparency, legal enforceability, and alignment with global banking standards. For companies, project developers, and investors navigating high-value contracts, understanding how SBLCs work and how they differ from traditional bank guarantees can be the key to structuring safer, more profitable deals.

In an increasingly interconnected and risk-sensitive business landscape, SBLC financing stands as a cornerstone of modern trade and project funding. Companies that leverage SBLCs not only mitigate risks but also position themselves for sustainable growth, stronger partnerships, and broader access to capital. In short, an SBLC is not just a safety net — it is a strategic asset for businesses aiming to thrive in competitive global markets.

Unlock the Power of Global Finance with SVF GP (Jersey) Limited

In today’s dynamic financial landscape, access to trusted, high-value funding solutions can make all the difference between vision and achievement. At SVF GP Limited, we specialize in empowering businesses, investors, and project developers with bespoke financial instruments and strategic capital solutions designed to bring ambitious ventures to life.

Whether you’re seeking Standby Letters of Credit (SBLCs), Bank Guarantees (BGs), or innovative monetization programs, our global expertise and deep institutional relationships ensure that you receive tailored support every step of the way. From structured project finance to secured lending and investment facilitation, we provide a transparent, results-driven approach that has earned the trust of clients across multiple industries and regions.

When you partner with SVF GP Limited, you gain more than a lender — you gain a strategic financial ally dedicated to helping you maximize liquidity, strengthen credibility, and accelerate project timelines. Our commitment to professionalism, discretion, and reliability ensures that every transaction is executed securely and efficiently, no matter the scale or complexity.

Don’t let funding barriers hold your business back. Take the first step toward realizing your financial goals today.

Contact our Structured Finance Team directly at StructuredFinance@svfgpltd.com

Visit www.svfgpltd.com to learn how we can tailor a financing solution that fits your vision.

SVF GP Limited — Your Global Partner for Secure, High-Value Financial Solutions. Empowering Ambition. Enabling Success.

Pingback: Real Estate Loans Explained: The 2025 Guide for Investors and Developers - SVF GP – SBLC, Bank Guarantees & Finance Experts

Pingback: How to Work with an SBLC Provider - SVF GP – SBLC, Bank Guarantees & Finance Experts

Pingback: Genuine SBLC Providers 2025: A Guide to Real Issuers - SVF GP – SBLC, Bank Guarantees & Finance Experts

Pingback: Bank Payment Undertaking (BPU): Meaning and Use - SVF GP – SBLC, Bank Guarantees & Finance Experts

Pingback: Best Bank Guarantee Providers in 2025 - SVF GP – SBLC, Bank Guarantees & Finance Experts

Pingback: Die besten Anbieter von Bankgarantien im Jahr 2025 - SVF GP – SBLC, Bank Guarantees & Finance Experts